Sales jobs are constantly evolving in an ever-changing industry landscape. Changes in customer behavior, new kinds of competition, shifting regulation, new methods of distribution and core technologies of production. Together, these factors have the potential to significantly change the nature of an industry. While some industries are on the decline, others are experiencing massive growth. It’s important to be prepared to pivot in your sales career in order to stay relevant and in demand.

So what are the top industries to look for a great sales job? At Peak Sales Recruiting, we’re finding the largest demand (and compensation) in four major B2B market segments: technology and software, healthcare, financial services, and consumer packaged goods (CPG). We’ll go over each industry, describe how they’re changing, present some of the challenges you need to be aware of, and show you why they’re worth exploring further.

Technology and Software

You’d be hard pressed to find a city that isn’t investing in infrastructure to attract tech jobs. Tech and software has long been a staple of the North American economy, dating back to the 60’s & 70’s in Silicon Valley where the first modern technology companies popped up, and still exist today. The dot-com boom in the 90’s, followed by explosive growth in digital in the 2000’s has kept this industry booming. Today’s industry is focused on mobility, SaaS, cybersecurity and automation.

Sales jobs continue to be highly desirable to professionals in this industry. Spiro points out the reasons these jobs are still so hot right now is that the demand is high, job satisfaction is high, pay is better than average, and career opportunities are plentiful and varied.

Growth is expected to expand as it’s “projected to grow 13 percent from 2016 to 2026, faster than the average for all occupations.” Plus, the industry is not just focused around Silicon Valley anymore. Cities from Austin to Toronto have become hotbeds for the tech community in North America.

There are a few segments of this industry that are really driving growth and creating opportunities:

Cybersecurity

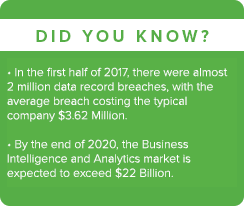

ByGoogleCybersecurity has grabbed a lot of headlines recently with the Russian election hacking and the Equifax data breach. In the first half of 2017 alone, there were almost two million

data record breaches, or about 122 individual records compromised per second – and these events are costly. The average breach costs a typical company 3.62 million, or about 225 dollars per record. This has led to a booming B2B industry with growth in the sector breaking records:

“Cybersecurity deals hit an all-time quarterly high of 146 deals in Q1’17, up 26 percent from the previous quarterly high. The trend held through Q2’17, which saw just one fewer deal (145 total) compared to Q1’17.

The amount of disclosed equity funding to cybersecurity companies has also recently broken records, reaching an all-time quarterly high of 1.6B dollars in Q2’17.”

Big Data / Predictive Analytics / Machine Learning / BI

It’s really hard to separate any of these tech industries as they’ve become so intertwined. Big data gathers the information for machine learning to process, which leads to predictive analytics and business intelligence.

By the end of 2020, the business intelligence and analytics market is expected to exceed 22 billion dollars.

“Purchasing decisions continue to be influenced heavily by business executives and users who want more agility and the option for small personal and departmental deployments to prove success,” said Rita Sallam, research vice president at Gartner. “Enterprise-friendly buying models have become more critical to successful deployments.”

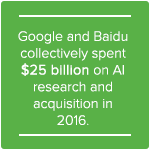

According to HBR Analytic Services, more than 60 percent of executives believe that their future success depends on the successful adoption of AI. In fact, more than a third of the executives that were interviewed are piloting, or in production, with tools powered by artificial intelligence. These early adopters have recognized that AI technologies will have a massive effect on the B2B revenue generation process. As such, these companies are starting to use tools that have embedded AI capabilities that can augment their “sales productivity, customer retention, account growth and other critical aspects of business success”.

Software as a Service (SaaS) / Cloud Products

Software has increasingly moved from an on-premise system that you purchase and own forever (or at least until you need an upgrade) to a cloud-based model where you pay a license fee monthly or yearly to use the software, but always have the latest version. Companies are increasingly transitioning to a cloud-based technology stack, so in order for software providers to stay relevant their solution offering must comply with the new norm.

One of the best examples is when Adobe made the switch to a subscription based model for all of their B2B products. This transformation has led to record revenues for the company. It’s no surprise that their salespeople are some of the most well paid and can expect an average yearly compensation of 183,000 dollars.

Another example of the growing shift is in accounting software. Recent startups like Xero are offering cloud accounting options as a service. This has forced traditional accounting firms like QuickBooks and Turbotax to adapt or die. With the accounting software industry alone expected to grow to 4 billion dollars by 2021, it’s easy to see the success of transforming a traditional software business to a SaaS model.

You can expect to be well paid as a salesperson in the tech industry as the average compensation is around $80k. However, top performers can easily reach six figures. Looking at the 10 best paying companies in the tech industry, a salesperson can expect to make between $150,000 to $250,000.

There are certainly challenges to working in this field however. Tech changes fast, and you don’t need to look any further than the shift in office-based software over the last two decades. Lotus 123 – the once dominant word processing software, was replaced by Microsoft Office as the standard in most businesses. And now with the prevalence of Google Docs, you’ll find that the use of Microsoft Office in the workplace is declining as well. There are dozens of reasons a tech company could fail, and obsolete tech is one of the most common.

Healthcare

As the baby boomer population retires, the general population expands, and medical technology advances, it’s easy to see why 7 out of 20 of the fastest growing industries on the Bureau of Labor Statistics website are in a healthcare related field.

Growth is explosive in the healthcare industry for two main reasons: an aging population, and a population that is sicker than ever. The healthcare industry is seeing growth in many different areas, including home healthcare, mobility devices, and sports injury centers. However, there are two segments that are highly desirable for sales professionals: pharmaceuticals and medical equipment.

Pharmaceuticals

The worldwide pharmaceutical market has grown from 390 billion dollars in 2001, to more than 1.1 trillion dollars in 2016. Almost half of that is in North America alone.

Although there have been some cutbacks in recent years, the outlook is very promising, with total sales jobs topping 400,000 in the US by 2022.

Medical Devices

Like pharmaceuticals, the medical equipment market is dominated by US companies. Over the next few years, these companies are expected to double their revenue growth rates.

“On average, analysts forecast that revenue at large medical-device companies will grow by between 4 and 5 percent per year over the next few years, considerably more than the 2 percent overall annual market growth recorded over the past five.”

The biggest downsides to the industry lie with insurance companies and government. Drug and medical equipment sales are highly regulated, even requiring approval of sales literature. On top of that regulation, treatment coverage is a moving target and what’s covered one day may not be covered the next and the product or solution you’re selling may no longer be relevant.

That said, compensation remains strong, and remains as one of the best paying sales jobs. The average compensation in the industry is almost 150,000 dollars between base salary and commission. Sales representatives also report many perks to the job, like great benefits, stock options, company cars, and 401k with matching contributions.

One thing to keep in mind: with rapid changes in healthcare, come new requirements for healthcare sales reps, as they’re expected to excel in a few different areas – most notably in digital marketing. This is due to how medical professionals are getting their info, which is to say not just from printed medical journals. If you can excel in these new areas, you can build a great career in this industry.

Financial Services

The financial services industry encompasses a range of B2B services that manage money. This includes everyday banking, stocks and bonds, financing, accounting, insurance products and more. The industry more than doubled in the last three decades, and it’s why you’ll find that financial services makes up an average of more than 20 percent of GDP in most developed countries. In the US, it’s estimated at 7.3 percent of total GDP, which is a massive 1.4 trillion dollars.

Recent years have seen a decline in financial advisor jobs and revenues. This is driven by a new generation of wealthy millennials that are declining to use financial advisors as new products and services become available. However, there is an area in financial services that is growing rapidly, and attracting top sales talent: FinTech.

Financial Tech (FinTech)

Historically, FinTech has referred to the back end computer systems that run the financial industries. This is no longer true, as FinTech is now used to reference all of the technology implemented into the financial services world. FinTech now includes everything from your mobile banking app, online trading platforms, fraud prevention software, machine learning, mobile payments, blockchain technology and the complex trading software used on wall street.

The growth in this industry is staggering:

“Funding continues to remain strong with US8.2 billion dollars invested in the third quarter of 2017. This is after more than doubling to US9.3 billion dollars in the second quarter… Investments in Fintech were still way above the US6.3 billion dollars raised in third quarter of 2016. The United States has led the in global fintech investments. Data shows that in the 3rd quarter of 2017 US5 billion dollars deployed across 142 deals. A major portion of the fintech industry is the blockchain market.”

Bitcoin has blown the blockchain market wide open. Although Bitcoin itself is not relevant here, the technology behind it is. Companies are investing in blockchain technology to secure almost any transaction or record, the stock market, and mobile transactions. We’re just learning about how valuable this technology can be to everyday financial services, but here are 35 real-world examples of blockchain tech in action.

Mobile / Digital Payment Solutions

A subset of FinTech, mobile and digital payment solutions is worth noting as it’s experiencing amazing growth on its own. Startups are creating peer-to-peer money exchanges that work by simply tapping two phones together, transit passes are going phone-based, and B2B transactions are expected to be the next trillion dollar industry.

The days of checkbooks and ATMs may be headed for the history books as this recent study shows:

“Mobile money services have proven to be an effective gateway for financial inclusion among the unbanked, a demographic that could evolve into a US3 trillion dollar payments volume opportunity. Tomorrow, your bankers or wealth manager will coach you throughout your day to take appropriate financial decisions based on a combination of artificial intelligence and transactional and contextual data. Frustration and cost will decrease as new business models and emerging technologies are being adopted to streamline onboarding processes, operations and client communication. The influence that FinTech is having on the market is growing and the long-term potential is even greater.”

Salaries in the financial services sales world vary greatly depending on the product or service you’re selling. Insurance sales are at the lower end of the spectrum and can expect to make above $50k, with an outlook of 10 percent growth over the next 10 years. Financial services, securities and commodities can expect to make closer to 70 thousands dollars with a ten year expected growth rate of six percent, or average. FinTech sales is a little harder to define overall, but quite often falls into the technology sales salary expectations in the first section and can hit six figures.

As with all industries, the challenges in financial services are similar. Businesses can be notoriously slow in picking up new technology. FinTech is also moving fast, which creates two problems: being able to communicate the latest changes to a client, and the dangers of becoming obsolete.

There’s also the issue of recessions and market crashes, which sometimes go hand-in-hand. No industry gets hit harder during a recession than the financial industry. If there’s less money to move around, there are less transactions occurring. This will eat into the desire to use these services and invest in new technologies.

Consumer Packaged Goods (CPG)

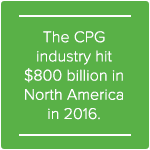

Consumer Packaged Goods, or CPG, are those purchases that we as consumers make frequently, most notably food, drinks, clothing, household products, and health and wellness. The CPG industry hit 800 billion dollarsin North America for 2016, and although actual dollar growth has slowed, this has more to do with deflationary pressures on currency than on product sales themselves.

“Imagine, if you will, that over the next decade the world will gain an additional 81 Procter & Gambles or 458 equivalents of Kellogg’s. This is the sort of growth that will happen in the global consumer-packaged-goods (CPG) sector, which will nearly double in size—to 14 trillion—by 2025, from eight trillion dollars in 2014.”

The growth in this category is fuelling investment into CPG at record rates. There are a couple of reasons why growth is so massive: Ecommerce and emerging markets.

Ecommerce

You don’t need look any further than Amazon’s acquisition of Whole Foods to see this growth in action. Before Amazon even purchased Whole Foods, Amazon’s online CPG growth was drastically outpacing the global industry.

If that’s not enough, 9 out of every 10 dollars of CPG growth is happening in online. E-commerce is no longer an option for CPG brands, it’s a must have.

Emerging Markets

As poorer nations continue to strengthen and grow their middle-class, like China and India to name a couple of the more populous nations, it’s opening new CPG markets to brands. Emerging markets are expected to grow CPG sales 3 times faster than developed nations, and reach 6 trillion dollars in sales by 2020.

70 percent of the world’s population lives in emerging markets, so the growth opportunity is substantial.

All of this growth is leading to more opportunity for the B2B CPG salesperson. One thing to note is that a lot of CPG sales jobs expect a level of formal education that is higher than most other sales jobs. While you can get away with experience in lieu of education in many fields, CPG sales often requires an MBA due to the complex nature of how CPG are sold, and the need to understand business economics even at the junior level. That being said, the top positions in CPG sales will regularly hit six figures, and hitting 300 thousand a year in salary and commission is regularly achieved by top performers.

The main challenges affecting CPG sales are slow or shrinking traditional growth. In-store retail growth has slowed or disappeared in almost all categories, at least for now. If you’re not keeping up with trends, you can expect sales to lag.

Consumers are also expecting a more personalized shopping experience. Instead of a cost effective one-brand-fits-all approach, companies are finding it’s better to have many brands to personalize the experience. It’s one reason you’ll find more Diet Coke varieties available in 2018 than at any time in history. Having a large number of complex brands can make things more challenging, so you need to adapt to trends quickly, or you’ll find yourself behind.

Sales jobs are some of the best paying positions in most companies because they are directly responsible for driving the organization’s revenues. As technology and industries change, sales will become more important than ever. Staying on top of trends will help you be properly equipped for decades to come.

relpost-thumb-wrapper

Related posts

close relpost-thumb-wrapper

Latest posts by Eliot Burdett (see all)

- 31 Must-Know Sales Follow-Up Statistics for 2024 Success – December 21, 2023

- 7 Success Characteristics That Define Top Performers – December 19, 2023

- 5 Reasons Your Top Employees Quit (Stop Doing This to Stop Them Leaving) – December 14, 2023