Understanding your recurring revenue stream is vital for businesses operating with a subscription-based revenue model. However, with two prominent metrics, Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR), determining the right one to use and its true meaning can be confusing.

Understanding the difference between ARR and MRR is crucial for making informed decisions about your business. This article provides a clear and concise explanation of the key differences between these two metrics, giving you the knowledge you need to choose the right option for your specific needs.

What is Recurring Revenue?

Recurring revenue is a revenue model that is especially significant for businesses offering subscription-based services, such as SaaS (Software as a Service) companies. It refers to a company’s regular and predictable income from its customers/customers each month or year.

SaaS or subscription businesses rely heavily on recurring revenue to sustain and grow their operations, making it a critical metric to track and understand.

For this reason, SaaS businesses primarily use two recurring revenue metrics: Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR).

ARR vs. MRR: What’s the Difference?

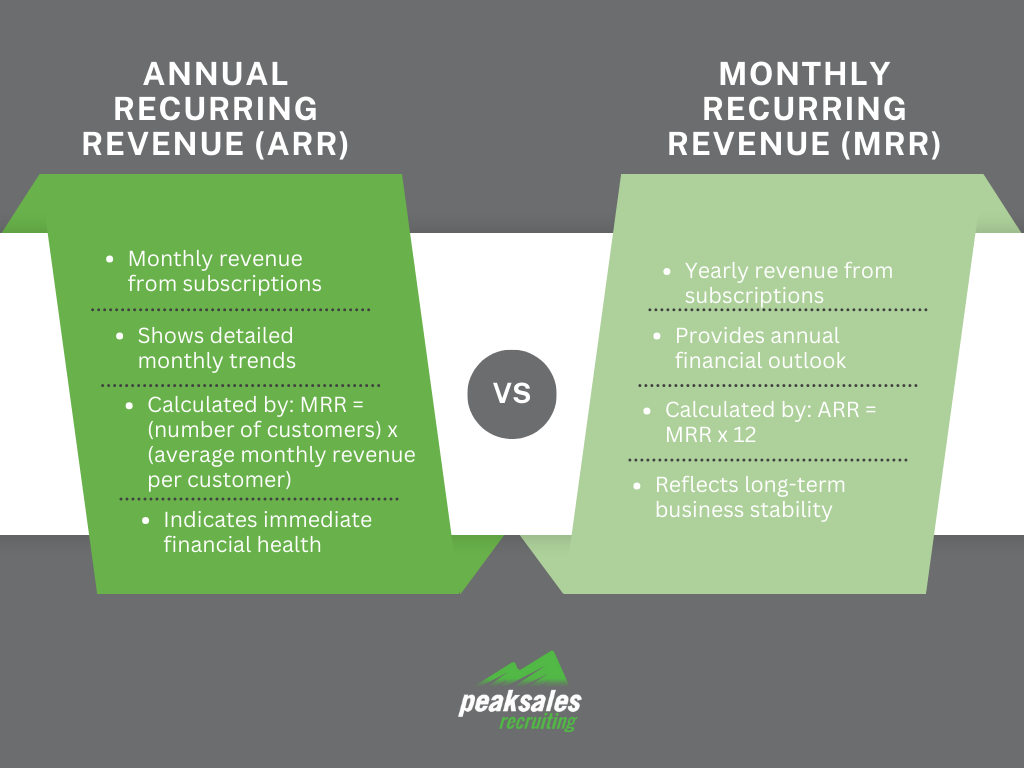

The primary difference between ARR and MRR is their timeframe. ARR is calculated on an annual basis, while MRR is calculated monthly.

ARR provides a big-picture view of a company’s revenue for the entire year, whereas MRR offers a more granular view of revenue earned each month.

What is Monthly Recurring Revenue (MRR)?

MRR, or Monthly Recurring Revenue, is an essential metric for a subscription-based SaaS company. It represents the total amount of revenue that a company expects to receive from its subscribers each month.

In other words, MRR is the sum of all the subscription fees a business collects from its customers monthly, giving you a total monthly subscription revenue.

MRR is an essential metric for SaaS companies because it provides a predictable and stable source of revenue that can help the business plan and forecast for the future. It is also a key indicator of a business’s growth and success, as increasing MRR over time is a sign of a healthy and thriving subscription-based business.

What is Annual Recurring Revenue (ARR)?

ARR, or Annual Recurring Revenue, is a significant financial metric for SaaS (Software as a Service) businesses with annual subscriptions.. It represents the predictable annual revenue that a SaaS company anticipates from subscriptions.

It’s an important metric because it helps SaaS businesses forecast revenue, measure growth, and evaluate the lifetime value of a customer.

Read our article “10 Key Sales Metrics to Measure in 2024” to stay ahead of the competition.

Why MRR Matters for a SaaS Business

Operational Management: MRR enables you to track your day-to-day financial performance. It’s ideal for monitoring monthly fluctuations, identifying growth trends, and assessing the impact of recent marketing or sales initiatives.

Short-Term Planning: Reflecting your immediate cash flow, MRR proves valuable for making short-term financial decisions like budgeting and resource allocation.

Identifying Churn: Tracking MRR allows you to swiftly identify any customer churn (loss of subscribers) and take corrective actions to prevent further revenue loss.

How to Calculate MRR

There are two ways to calculate MRR:

Average Method:

(Total recurring revenue at the end of the month + Total recurring revenue at the beginning of the month) / 2

Subscription-Based Method:

Number of subscribers * Average subscription price

Why ARR Matters for a SaaS Business

Financial Reporting and Forecasting: ARR is a standard metric used in annual reports and financial statements to showcase your business’s overall health and financial performance.

Valuation: Investors often use ARR to assess a subscription business’s potential and value for investment purposes.

Long-Term Growth Prediction: Analyzing historical ARR trends helps predict your business’s future growth trajectory.

How to Calculate ARR

Calculating ARR is straightforward: simply multiply your MRR by 12.

ARR = MRR * 12

The Bottom Line

ARR and MRR are vital metrics that can help subscription businesses in various ways. By understanding their differences and use cases, companies can make informed decisions and take necessary actions to improve their business health, attract investors, and achieve long-term growth potential.

Therefore, subscription businesses must measure and track these metrics regularly and incorporate them into their decision-making processes. By doing so, companies can stay ahead of the competition and succeed in today’s subscription-based economy.

For more sales guides and tips, visit our blog.