The economic impact of COVID-19 is undeniable. Around the world, stock markets lost approximately one-third of their values between February 20 and the end of March, with more than 20 million Americans and 1.5 million Canadians being laid off.

In the face of shifting consumer behavior, businesses in North America and across the world have had to adapt to these rapidly changing economic and socio-economic circumstances. New strategies, resource allocations, and tactical approaches have been implemented, but questions about the effectiveness of such changes still remain – particularly within sales departments.

To help provide business leaders with a perspective on the evolving situation and implications for their company’s sales force, Peak Sales Recruiting launched the COVID-19 Sales Force Impact study. Collecting data from more than 500 VPs, Front-line Managers, and Individual Contributors from across North America, the study examines how COVID-19 and resulting changes in the market have impacted sales teams’:

- Performance Levels;

- Hiring, Job Security, & Related Perceptions;

- Metal Health & Motivation;

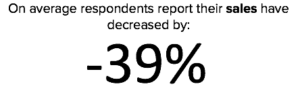

While there are variations that affect the degree to which COVID-19 is impacting the variables measured, the results of this study indicate that COVID-19 has negatively impacted sales leaders and their teams. More than 15% of respondents indicated that they have been laid off as a direct result of the COVID-19 crisis, while more than 45% do not feel confident about their job security and employment stability. On average, respondents indicated that sales have decreased by 39% since the pandemic hit North America, which is also taking a toll on the mental health of team members. More than 60% of respondents stated their mental health has been negatively affected, while 40% indicated that their organizations have “not done enough” to manage the situation.

Taken together, the data paints a dark picture. It underscores the need for team leaders to listen and empathize with the cold realities salespeople are facing in this new selling environment. It requires new management approaches that focus on the mental health and job satisfaction levels of individuals as key ways to improve selling performance. The data also tells front-line sellers that conventional sales techniques and “business as usual” approaches are not working. So where do leaders and their teams go from here? It is our intention that the data and accompanying commentary below help answer that question.

Sales Performance Levels:

Since the pandemic hit North America in mid February, study respondents indicated that “successfully closed” / “won” deals have declined by 39%, while productivity declined by 20%. Both Men and Women experienced similar declines in sales and productivity (-38% vs -42% and -20% and -19%), as did all quota-carrying roles (individual contributors, front-line managers, and sales leaders). In examining how COVID-19 has impacted specific industries, Professional Services has been hardest hit. Respondents faced a 45% decline in won deals, with a staggering 24% decline in productivity. Small companies, those ranging from 1-100 employees, have experienced the largest sales declines at 47%, more than 20% higher than the average.

From a regional perspective, those companies located in the US Midwest and Southwest have experienced average sales declines of 41% and associated drops in productivity by 38%. The US Northeast, a region particularly hard hit by COVID-19 has experienced a 39% decline in sales, and a 21% decline in productivity. Canadian respondents indicated a 40% decline in sales, with only a 15% decline in productivity.

With a significant decline in sales and productivity, revenue leaders have taken action. More than 45% of respondents indicated that their organization’s go-to-market strategies have changed. Using data from Hubspot’s 2020 COVID-19 Sales and Marketing Study, sales teams are now increasing their use of outbound email and social selling strategies, experiencing varying levels of success. On a per-week basis, companies sent 23% more sales emails during the week of March 16 compared to prior weekly averages in Q1. Response rate to those emails began falling the first week of March, with a total decrease of 27% in March compared to February.

So what are the appropriate actions that sales leaders need to take to slow or reverse these sales declines? And how have front-line reps adjusted their selling approaches to connect with prospects and retain key customers? See Peak’s tips in our latest post – Boosting Sales Team Morale When No One is Buying.

Hiring, Job Security, & Related Perceptions:

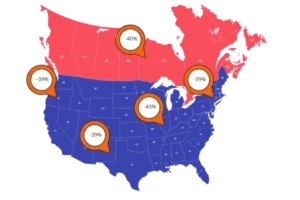

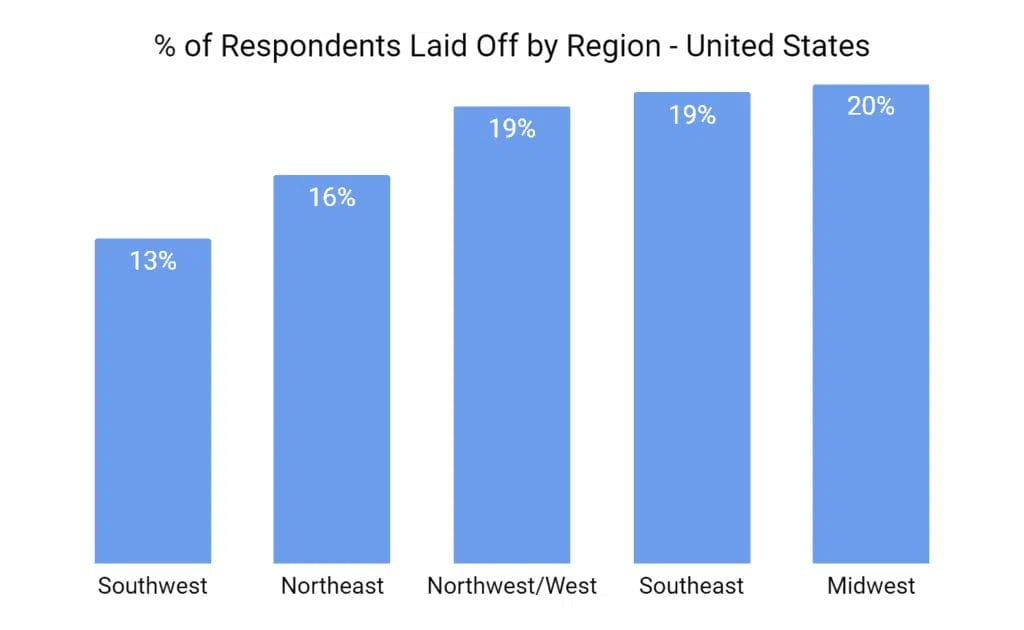

More than 15% of survey respondents have been laid off as a direct result of COVID-19 and its impact on company revenues and cash-flow projections. Particularly hard hit were front-line sales managers and quota-carrying reps from small companies. More than 20% of respondents from those segments were laid off, compared to just 5% of respondents from large enterprises.

From a regional perspective, the US midwest and southeast have seen the largest % of layoffs, while respondents from northeastern and southwestern regions were the least affected.

These layoffs have taken a toll on employee engagement and perceptions of job security. More than 40% of respondents from Professional Service, Information Technology and Services (ITS), and Software companies indicated that they felt “insecure” about their job. Those from companies with less than 1000 employees were most likely to feel insecure about their future employment status, however, those at larger companies felt more “neutral”, not necessarily “secure”.

In examining data by gender, there is no significant overall difference in job security perceptions. However, when examining the various perception levels of job security (very secure, secure, neutral, insecure, very insecure), 7% more male respondents indicated that they were “very insecure” when compared to women. This finding is reflected at the opposite end of the job security spectrum, with 6% more male respondents indicating that they felt their job was “very secure”.

So what actions can leaders take to improve team morale and perceptions of job security? And more specifically, what immediate actions have corporate leaders undertook to preserve quota-carrying jobs?

Companies like Goodway Group have been hosting virtual half-hour “Family Fun Friday” events where employees and their families can relax and interact, while Vox Media is hosting a daily story time for parents with kids. Infutor gave its US employees a $100 Amazon gift card, while Facebook gave employees a $1000 bonus to help equip them for the new normal. Other companies like Lululemon have cut pay for their most senior managers, while Lyft (LYFT) co-founders John Zimmer and Logan Green pledged to donate their salaries through June. Within the sales industry, many companies have reduced base salaries and increased the variable portion of their sellers compensation packages. Others have reduced or outright eliminated variable bonuses for individuals, instead opting for team-performance bonuses. For an in-depth review of the sales compensation landscape, read the American Association of Inside Sales Professionals (AAISP) 2019 Sales Compensation Study.

Team Mental Health and Motivation:

60% of respondents indicated that their mental health has been negatively affected by the circumstances surrounding COVID-19. This is significantly impacting motivation levels, with more than 45% of respondents suggesting that the situation has negatively impacted it. Regionally, the US northeast, westcoast, and midwest reported that the pandemic negatively impacted their mental health at more than 10% of the national average.

Data examining the impact of the pandemic on organizational size was consistent regardless of company size. The exception was for respondents working in organizations that had between 201-500 employees, where more than 70% of respondents indicated that the situation negatively impacted their mental health. These findings align with the results that tested the impact on motivation levels. Respondents from organizations with 201-500 employees reported 24% lower levels of motivation compared to the average sample.

The COVID-19 pandemic has also had a more significant impact on the mental health and motivation levels of women when compared to men. 67% of women respondents stated that their mental health was negatively impacted, compared to only 60% of men. More than 55% of women reported decreased motivation, compared to only 43% of men.

For corporate and sales leaders alike, this data suggests that more needs to be done to understand and ultimately improve the mental health of all members of the sales organization. In particular, quota-carrying individual contributors’ mental health and motivation levels were more negatively affected in comparison to their peers, which suggests that performance expectations need to be adjusted to meet changed buyer preferences. It also suggests that new motivation techniques and incentives need to be tested, specifically those that are digital in nature.

Where to Go From Here

As infection curves start to flatten, national and regional governments have shifted their focus and efforts on ways to restart the economy. McKinsey and others have proposed various models and market restart scenarios to guide policy makers. However, there are still outstanding questions around the scope of a market restart and timing. This provides little clarity for corporate leaders tasked with resuming business in a post COVID-19 world. So what can revenue leaders do – and what have they already implemented – to successfully adapt to the realities faced by their sales teams today? And what strategies and tactics need to be prepared to respond to the market’s pent-up demand?

To answer these questions and more, Peak is continuing its COVID-19 coverage but launching a second study: COVID-19: Sales Force Recovery Study.

To participate – follow this link.

The study takes 5 minutes to complete and all participants will be granted exclusive access to the results. For every participant, Peak will also be making a donation to the Helping Heroes fund.

Related posts

Latest posts by Eliot Burdett (see all)

- 31 Must-Know Sales Follow-Up Statistics for 2024 Success – December 21, 2023

- 7 Success Characteristics That Define Top Performers – December 19, 2023

- 5 Reasons Your Top Employees Quit (Stop Doing This to Stop Them Leaving) – December 14, 2023