Software as a Service (SaaS) has become one of the fastest-growing segments in the technology industry, and for good reason. With its subscription-based pricing models and on-demand software accessible online, SaaS businesses offer convenience and flexibility that traditional software companies cannot match.

However, measuring the health and success of a SaaS business is more complex than looking at revenue numbers alone. In this article, we’ll look at two key metrics used to measure recurring revenue in the SaaS industry, Annual Recurring Revenue (ARR) and Annual Contract Value (ACV), and how they differ.

What is Annual Recurring Revenue (ARR)?

ARR represents the total recurring revenue a company expects to generate in a one-year period. This metric considers all revenue streams providing predictable, ongoing income, primarily from subscriptions and renewals.

For instance, if a customer pays a monthly fee of $100, their annual recurring revenue contribution would be $1200 ($100/month * 12 months).

ARR is a vital metric for tracking growth, forecasting future revenue, and gauging the overall health of a subscription-based business.

What is Annual Contract Value (ACV)?

ACV focuses on the value of a single customer contract annually. It reflects the total revenue generated from a specific customer over a one-year period.

Unlike ARR, ACV can include one-time fees, upfront payments, and recurring charges.

Let’s say a customer signs a one-year contract for $3,600. If this is the total amount they pay for the year (no recurring fees), their ACV would be $3,600.

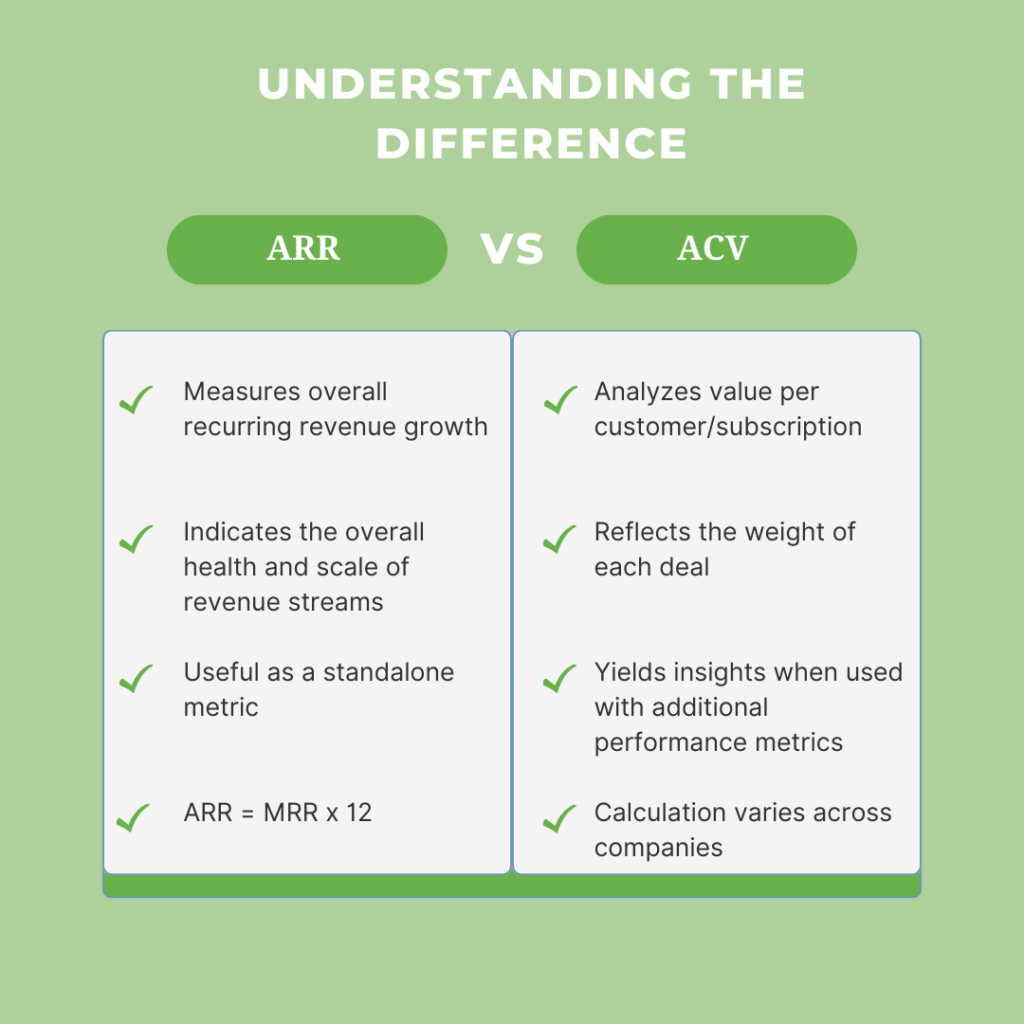

ARR vs. ACV

Here’s a table summarizing the key differences between ARR and ACV:

| Metric | Focus | Includes | Use Case |

| ARR | All Customers | Recurring Revenue (Subscriptions, Renewals) | Measures overall recurring revenue growth, company health |

| ACV | Single Customer | Total Contract Value (Recurring + One-Time Fees) | Analyzes value per customer, informs sales and marketing strategies |

How Companies Benefit from Using ARR and ACV

- Tracking Growth: Both ARR and ACV help track year-over-year growth in recurring revenue.

- Goal Setting: Companies can set specific goals for ARR growth based on market conditions and business objectives. Salespeople can establish ACV targets to guide efforts toward acquiring high-value customers.

- Customer Acquisition Cost (CAC) Analysis: ACV helps assess customer acquisition costs by providing the average revenue generated per customer. This allows companies to determine if their customer acquisition strategies are sustainable.

- Resource Allocation: Understanding customer value through ACV allows companies to allocate resources effectively for customer success initiatives.

How to Calculate ARR and ACV

How to calculate ARR

There are two standard methods to calculate ARR:

- Monthly Recurring Revenue (MRR) Method: Multiply your monthly recurring revenue by 12 (months in a year). If your MRR is $10,000, your ARR would be $120,000 ($10,000 * 12).

- Annual Contract Value Method: If your contracts are typically for one year and have no upfront fees, you can simply total the value of all your annual contracts.

How to Calculate ACV

Divide the total contract value by the contract length (in years). For example, for a one-year contract of $3,600, ACV would be $3,600 (total contract value) / 1 year (contract length).

The Bottom Line

To sum up, ARR and ACV are crucial metrics for the success of SaaS businesses. By monitoring these metrics, companies can make informed decisions that lead to better sales and marketing strategies, stronger customer relationships, and sustainable growth. Prioritizing these metrics can help SaaS companies thrive in the competitive digital marketplace and achieve long-term success.

For more sales metrics, guides, and tips, visit our blog.